Portfolio

plan of Boston Consulting Group (BCG) that has been developing since 70's is

based on the assessment analysis of existing products, possibilities of modifying products or manufacturing new ones.

Starting from researches done by BCG, it has been concluded that a strategic

position of business is determined in accordance with relative market participation and a market growth rate.

Relative market participation is

considered to be a

market participation of a product in relationship with a leading competitor in

the production of similar garments.

Growth rate

can be positive (meaning growing market), nought (standing for stagnated

market) and negative (i.e. falling market in future). Market growth rate is

indicated with "low" and

"high" in BCG matrix meaning that market growth rate of that garment

manufactures is lower or higher than growth of an entire economy of the region.

At so

called Boston

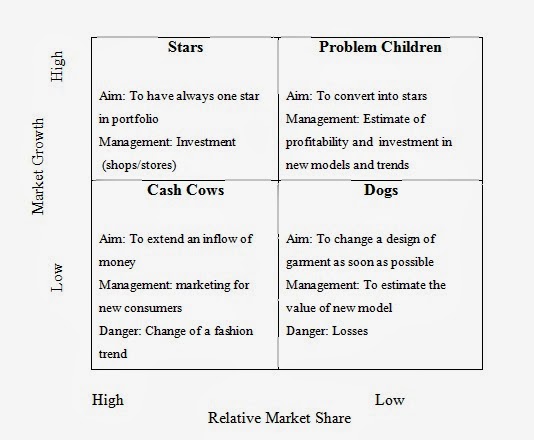

● Stars - products

with a high participation on a market and a high market growth rate (garments

that bring profit but needs a large investment in textile material as well as a

technological process of production).

● Stars - products

with a high participation on a market and a high market growth rate (garments

that bring profit but needs a large investment in textile material as well as a

technological process of production).

● Cash cows - garments that are main sources of profit

● Dogs - products with low growth rate and low rate of market

participation (garments with low participation on a market that stagnates -

stops producing them).

● Problem children (question mark) - products with a high growth rate and

small market participation (garments that

bring small profit, but are promising so they cannot be neglected).

According to this matrix an integral indicator of

all market characteristics stands for a

growth from the following reasons:

-

growth is the best measure of life cycles of a product,

-

it is easier to win a market share when product attracts new customers,

-

it is easier to keep than to conquer a market,

-

market is larger and non-competitive on a growing market,

-

new competitors can be discouraged by aggressive appearance on a growing market.

Trying to remove the shortage of BCG matrix,

Boston Consulting Group has designed a new portfolio matrix. New BCG matrix has

a changed coordinate of relative market participation with "a great

advantage that is going to be designed in regards to other competitors", and a market

growth rate has been changed by "a large number of unique ways used for

creating advantages".

Some limitations of the BCG matrix

model include:

- The first problem can be how we define market and how we get data about market share.

- A high market share does not necessarily lead to profitability at all times.

- The model employs only two dimensions – market share and product or service growth rate .

- Low share or niche businesses can be profitable too (some Dogs can be more profitable than cash Cows).

- The model does not reflect growth rates of the overall market.

- The model neglects the effects of synergy between business units.

- Market growth is not the only indicator for attractiveness of a market.

i was just browsing along and came upon your blog. just wanted to say good blog and this article really helped me.

ReplyDeleteProm Dresses

Wonderful post. Thanks for sharing such a nice post you will try this business with more profit. For more information click here low investment business in indore

ReplyDeleteBCG matrix is to evaluate the strategic position of the business brand portfolio and its potential. It classifies business portfolio into four categories. For understanding this, BCG Matrix Examples resources are essential.

ReplyDeleteYou have a good point here!I totally agree with what you have said!!Thanks for sharing your views...hope more people will read this article!!! Harrison Barnes Recruiter

ReplyDeleteThank you so much for sharing this great blog.Very inspiring and helpful too.Hope you continue to share more of your ideas.I will definitely love to read. Harrison Barnes Los Angeles Recruiter

ReplyDelete